san francisco sales tax rate july 2021

California City County Sales Use Tax Rates. The current total local sales tax rate in San Lorenzo CA is 10250.

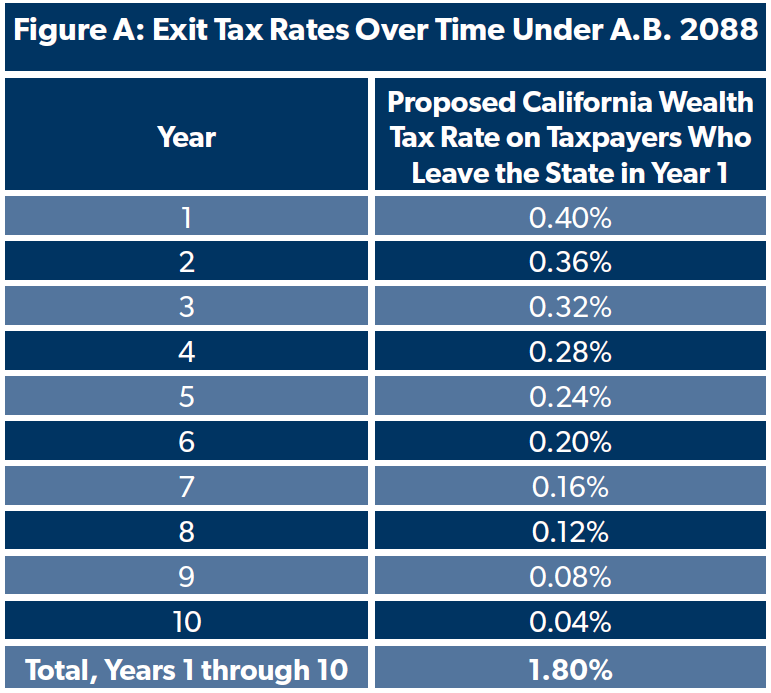

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

The San Francisco Tourism Improvement District sales tax has been changed within the last year.

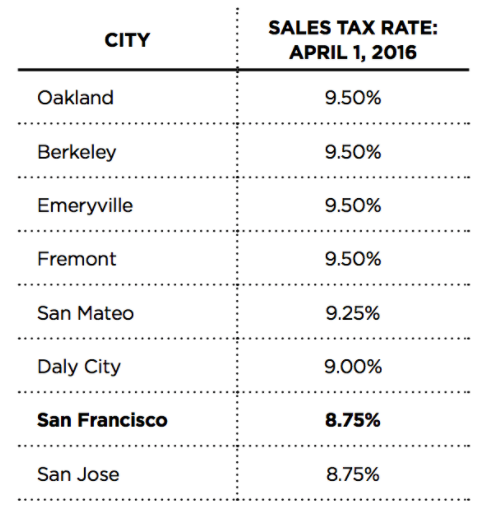

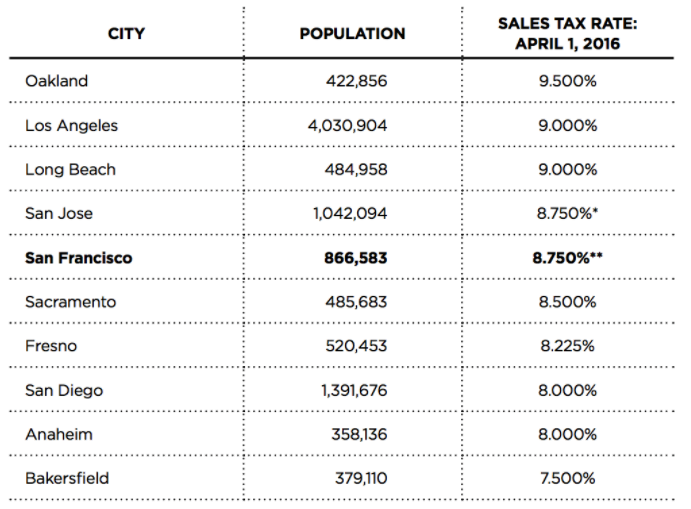

. Five other citiesFremont Los Angeles and Oakland California. Assessment of the Sales and Use Tax on Purchases. This is the total of state county and city sales tax rates.

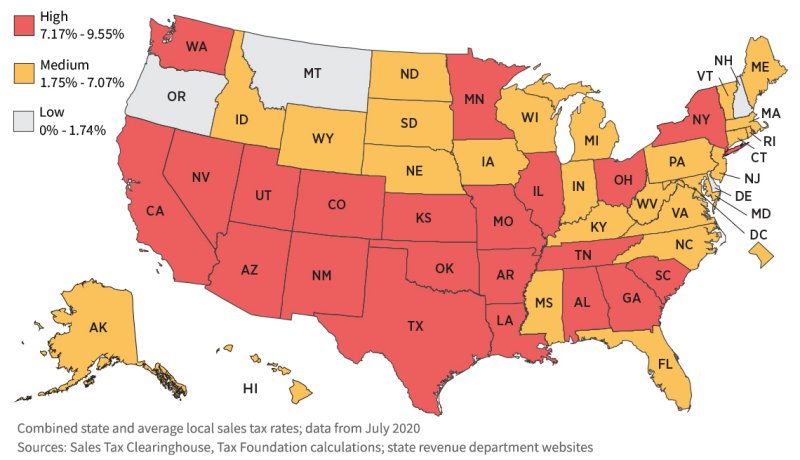

To review the rules in California visit our state-by-state guide. The San Joaquin County Sales Tax is collected by the merchant on all. The lowest non-zero state-level sales tax is in Colorado which has a rate of 29 percent.

The minimum combined 2022 sales tax rate for San Francisco California is. This is the total of state county and city sales tax rates. Español Filipino 中文 to better understand how to navigate San Francisco property taxes.

Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax. Secured Property Tax bills are mailed in October. And the SF Gross Receipts Tax Computation Worksheet to determine your San Francisco Gross Receipts Tax obligation.

The California sales tax rate is currently 6. Birmingham Alabama at 10 percent rounds out the list of. That means they all share the distinction of having the highest sales tax.

What is the sales tax rate in San Francisco California. The San Francisco sales tax rate is. The California vendors.

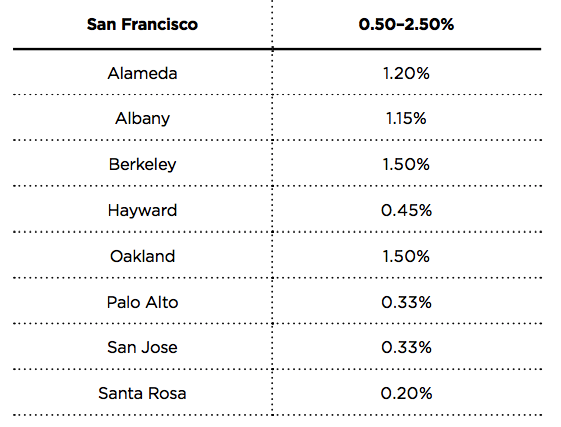

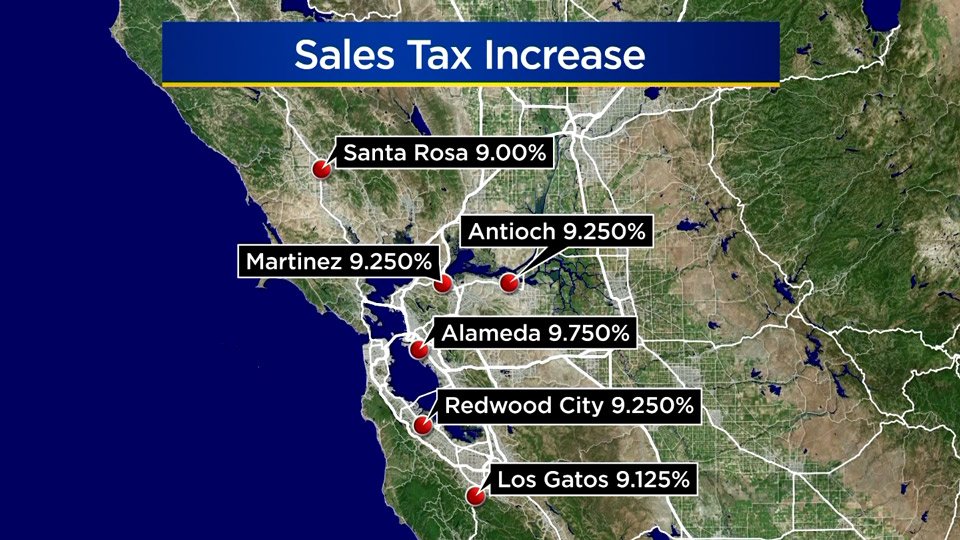

Tax Rate and then select the Sales and Use Tax Rates. Union City is among the six Alameda cities with a sales tax of 1075. - The sales tax is increasing in more than a dozen Bay Area cities and counties.

The County sales tax rate is 025. July 1 2021 701 PM CBS San Francisco ALAMEDA COUNTY KPIX 5 As of Thursday sales tax rates in Alameda County have gone up. CA Sales Tax Rate.

1788 rows California City County Sales Use Tax Rates effective April 1. The California sales tax rate is currently 6. Click here to find.

How much is sales tax in San Francisco. Mailed between July 1 and October mail date printed on bill. San Francisco California sales tax rate details The minimum combined 2021 sales tax rate for San Francisco California is 863.

And Seattle Washingtonare tied for the second highest rate of 1025 percent. Four states tie for the second-highest statewide rate at 7 percent. Did South Dakota v.

This is the total of state county and city sales tax rates. SAN FRANCISCO KRON Several Bay Area cities saw a Sales Use tax hike go into effect on April 1. San Francisco CA Sales Tax Rate.

The 2018 United States Supreme Court decision in South Dakota v. The December 2020 total local sales tax rate was 8500. The San Mateo County sales tax rate is.

For 2021 Gross Receipts Tax rates vary depending on a business gross receipts and business activity. 2021 State Sales Tax Rates. The December 2020 total local sales tax rate was 9250.

In San Francisco the tax rate will rise from 85 to 8625. City of Union City. The County sales tax rate is 025.

Webpage and select. Automating sales tax compliance can help your business keep compliant with changing. Thursday July 01 2021.

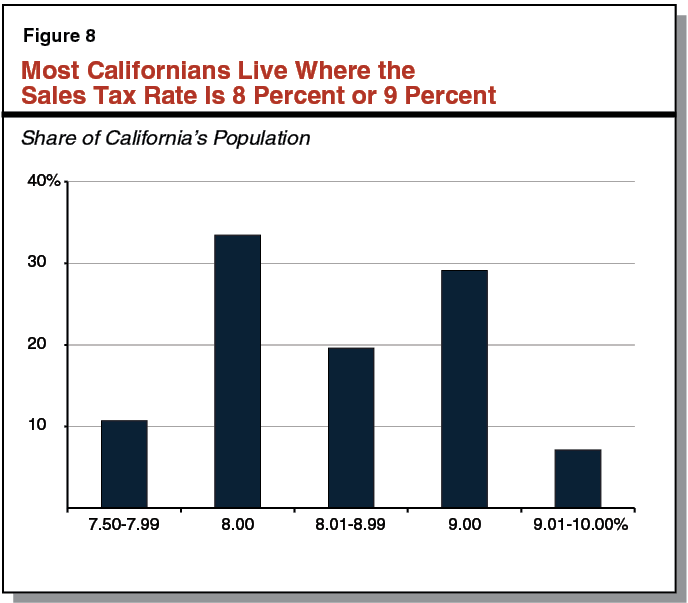

California has the highest state-level sales tax rate at 725 percent. The California sales tax rate is currently. You may also call our Customer Service Center at 1.

The Sales and Use tax is rising across California including in San Francisco County. Bay Area house sells. City of San Leandro.

Has impacted many state nexus laws and sales tax collection requirements. What is the current sales tax rate in San Francisco CA. The secured property tax rate for Fiscal Year 2021-22 is 118248499.

The minimum combined sales tax rate for San Francisco California is 85. Among major cities Tacoma Washington imposes the highest combined state and local sales tax rate at 1030 percent. Indiana Mississippi Rhode Island and Tennessee.

The County sales tax rate is. 91 in Santa Clara County and 1025 in. The San Joaquin County California sales tax is 775 consisting of 600 California state sales tax and 175 San Joaquin County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc.

It was raised 0125 from 975 to 9875 in July 2021. From there go to the. The new rates will be displayed on July 1 2021.

San Francisco and San Jose both increased their sales taxes by 0125 percentage points to 8625 and 9375 percent respectively as a result of voter-approved measures while many other jurisdictions in the areaincluding the counties of Alameda San Mateo. Tax rate for nonresidents who work in San Francisco. Nonresidents who work in San Francisco also pay a local income tax of 150 the same as the local income tax paid by residents.

Delinquent After 500 pm on. The sales and use tax rate is determined by the point of delivery or the ship to address. The current total local sales tax rate in San Francisco CA is 8625.

It was raised 0125 from 85 to 8625 in July 2021 raised 0125 from 85 to 8625 in July 2021 raised 0125 from 925 to 9375 in July 2021 and raised 0125 from 85 to 8625 in July 2021. The partial exemption rate is 39375 making partial sales and use tax rate equal to 45625 for San Francisco County and 53125 for South San Francisco San Mateo County. The South San Francisco sales tax has been changed within the last year.

The raise was approved by California voters in the Nov. Find a Sales and Use Tax Rate by Address. Estimated business tax payments are due April 30th July 31st and October.

As of Thursday the sales tax is now more than 86 in San Francisco.

What Taxes Are Involved When Selling My Online Business

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

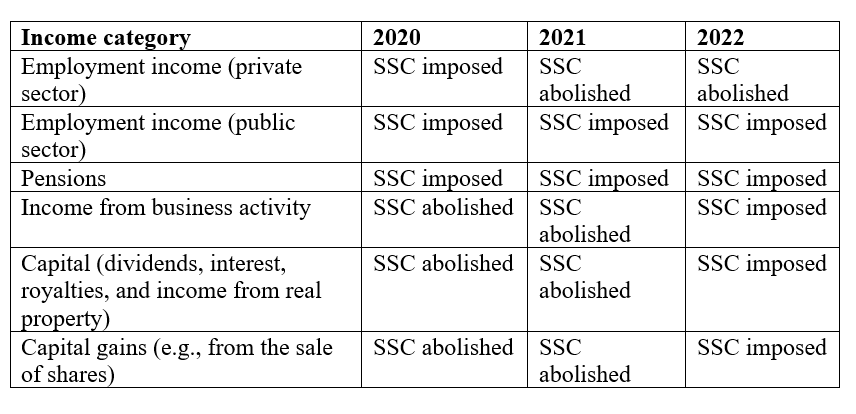

Greece Enacts Corporate Tax Rate Reduction Other Support Measures Mne Tax

Opinion Why California Worries Conservatives The New York Times

California City County Sales Use Tax Rates

San Francisco Prop W Transfer Tax Spur

Sales Gas Taxes Increasing In The Bay Area And California

Understanding California S Sales Tax

California Sales Tax Rates By City County 2022

States With Highest And Lowest Sales Tax Rates

California Sales Use Tax Guide Avalara

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Sales Tax By State Is Saas Taxable Taxjar

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Understanding California S Sales Tax

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Sales Tax Rates Rise Monday Out Of State Online Sellers Included Cbs San Francisco